8 Easy Facts About Insurance Shown

Wiki Article

Getting The Insurance To Work

Table of ContentsInsurance - TruthsLittle Known Facts About Insurance.Excitement About InsuranceSee This Report on InsuranceThe Only Guide for InsuranceNot known Facts About Insurance

While we usually can't avoid the unforeseen from occurring, often we can get some security. Insurance policy is indicated to secure us, at the very least financially, should specific points happen. There are countless insurance policy alternatives, and also many monetary experts will certainly claim you require to have them all. It can be difficult to determine what insurance coverage you truly need.Elements such as children, age, lifestyle, as well as employment benefits contribute when you're developing your insurance policy portfolio. There are, nevertheless, four kinds of insurance that many financial professionals suggest we all have: life, health and wellness, auto, and long-term impairment. 4 Kinds Of Insurance Every Person Needs Life insurance policy The best benefits of life insurance coverage consist of the capability to cover your funeral expenses as well as give for those you leave behind - Insurance.

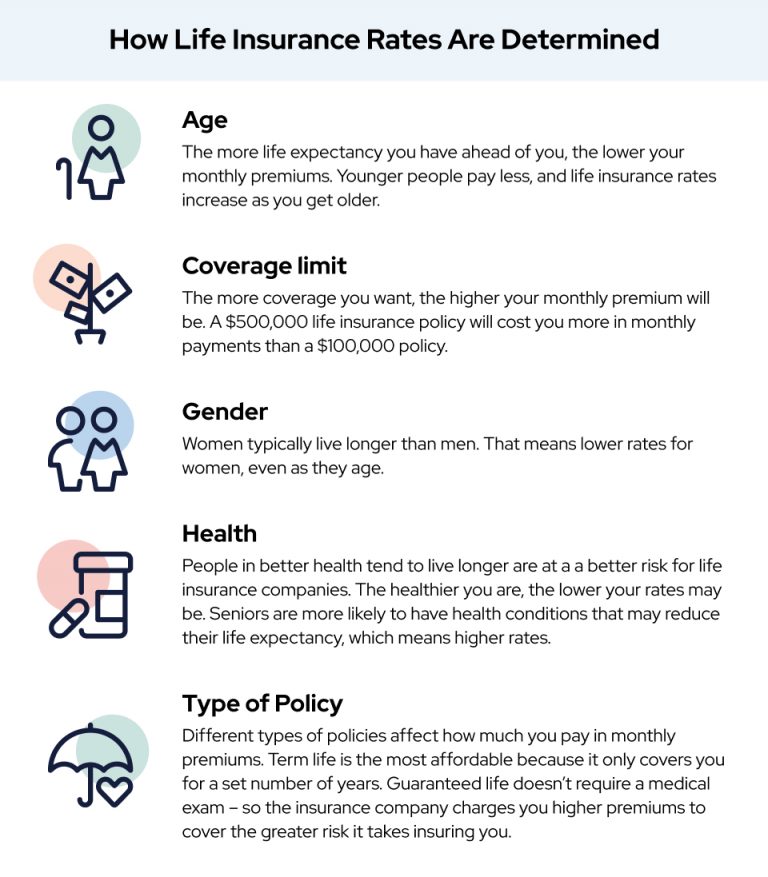

homes count on double revenues. The research study also found that a quarter of households would experience monetary challenge within one month of a breadwinner's fatality. Both standard types of life insurance policy are traditional whole life and also term life. Just clarified, entire life can be made use of as an earnings device along with an insurance coverage instrument.

Insurance Can Be Fun For Everyone

Term life, on the various other hand, is a policy that covers you for a set amount of time. There are various other substantial differences between both sorts of insurance coverage, so you may wish to seek the recommendations of a financial expert before you choose which is best for you. Elements to think about include your age, profession, and number of reliant youngsters.

If that's not an alternative, you'll require to purchase exclusive medical insurance. Long-Term Impairment Coverage Long-term special needs insurance policy is the one sort of insurance the majority of us assume we will never ever require. According to data from the Social Protection Administration, one in 4 employees entering the labor force will end up being impaired and also will be not able to work prior to they reach the age of retired life.

While health and wellness insurance policy spends for hospitalization as well as medical bills, you're still entrusted to those daily costs that your income typically covers. Lots of employers supply both short- and long-lasting disability insurance policy as part of their advantages plan. This would be the most effective alternative for protecting budget-friendly special needs protection. If your employer doesn't offer long-term coverage, here are some points to consider before buying insurance policy by yourself.

The 7-Second Trick For Insurance

25 million authorities reported check my source vehicle crashes in the US in 2020, according to the National Highway Traffic Safety And Security Administration. An estimated 38,824 people passed away in vehicle accidents in 2020 alone. According to the CDC, vehicle crashes are one of the leading reasons of fatality around in the United States and around the globe.In 2019, economic costs of deadly vehicle mishaps in the US were around $56 billion. States that do require insurance policy conduct regular random checks of motorists for proof of insurance.

Insurance - Questions

Again, similar to all insurance coverage, your individual scenarios will certainly establish the price click for more info of auto insurance. To make certain you get the ideal insurance policy for you, our website compare numerous rate quotes as well as the coverage supplied, and check regularly to see if you certify for reduced prices based on your age, driving record, or the location where you live.

Life will certainly throw you a curve ball there's no doubt regarding that. Whether you'll have insurance coverage when it does is another matter completely. Insurance coverage barriers you from unforeseen prices like medical expenses. As well as while the majority of people know that insurance is important, not every person understands the various kinds of insurance around and exactly how they can help.

The Ultimate Guide To Insurance

Those with dependents In the event of fatality, a life insurance plan pays a beneficiary an agreed-upon amount of cash to cover the expenses left by the deceased. A beneficiary is the individual or entity called in a policy who receives benefits, such as a partner.Occupants Occupants insurance is utilized by tenants to cover individual residential or commercial property in case of damages or theft, which is not the responsibility of the landlord. Make sure the price of your airline tickets is covered in instance of medical emergencies or other events that may create a trip to be reduced short.

Paying right into family pet insurance policy might be extra cost-effective than paying a swelling amount to your vet should your pet need emergency clinical treatment, like an emergency space visit. Family pet proprietors Pet insurance (mainly for dogs as well as cats) covers all or part of veterinary therapy when a pet is hurt or unwell.

The Definitive Guide to Insurance

Greater than 80% of without insurance respondents who had an emergency situation either can not pay for the expenses or required 6 or even more months to settle the expenses. While Medicare and Medicaid receivers were the least likely to have to spend for emergency situation costs, when they did, they were the least able to manage it out of the insured populace.Report this wiki page